A common financial concern amidst the COVID19 crisis is the impact of the share market downturn on Superannuation accounts and what one ought to do about it. If you are an ‘accumulator’ (typically those with longer than 5 years until retirement), you should do nothing if you are invested in a well diversified investment strategy with a reputable Super fund.

This is because:

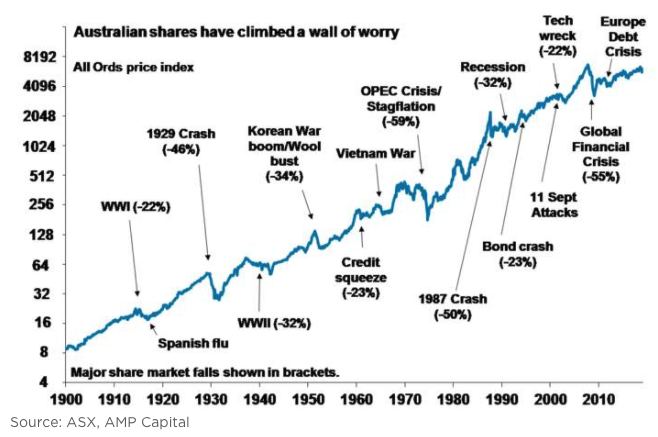

1. Market volatility and downturns go hand in hand with investing in shares. This is the precise reason that you are paid a risk premium for investing in shares as you are exposed to the downturns which occur periodically. History shows us that no matter how big the crisis, share markets always recover:

2. Switching to a conservative strategy amidst a down turn, will ‘lock in a loss’. To illustrate the point, assume you own a stock that has a price of $100, sell when the price drops to $80, and buy it back when the price returns to $100, you’re out $20 a share. Unless you know that the price will never, ever go back to $100, it is better to hold on to the stock than to sell at $80.

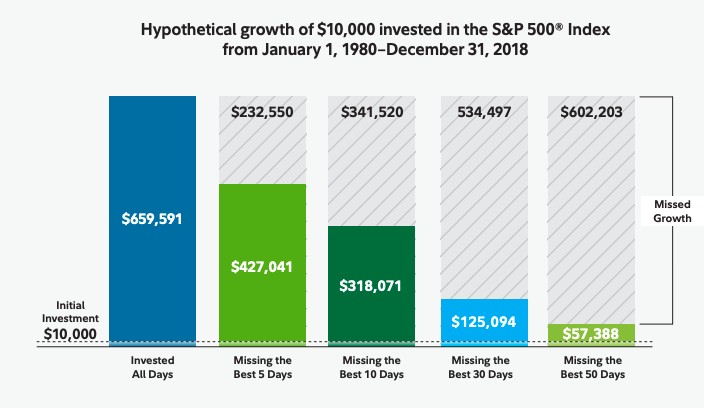

3. Trying to time the market by switching strategies to avoid losses can be disastrous. The following chart by Fidelity (2018) shows the growth of $10,000 invested from 1980 to 2018 (in a S&P500 Index Fund) and the impact if you missed the best 5 days as a result of mistiming. Your overall result will be 35% worse and the results get worse the more best days you miss.

The content on this page is general advice only as we have not taken into account your personal and financial circumstances when making this recommendation. We invite you to contact us should you have any concerns about your current investments and/or if your circumstances have changed to ensure our previous recommendations remain appropriate.

Sources:

Fidelity Investments (2018), Stay invested: Don’t risk missing the market’s best days, Fidelity https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/dont-miss-best-days.pdf

Oliver, S (2019), Five great charts on investing – why they are particularly important now, AMP Capital: AMP https://www.ampcapital.com/au/en/insights-hub/articles/2019/february/five-great-charts-on-investing-why-they-are-particularly-important-now