Are you impacted by COVID-19 and thinking about using the Federal Government’s Early Release of Super provision to access your Super?

WHAT IS IT?

Subject to certain eligibility criteria individuals facing significant financial hardship as a result of COVID-19 may apply to access up to $10,000 of their superannuation in the 2019-20 financial year. A further $10,000 may be withdrawn in the 2020-21 financial year.

WHO IS ELIGIBLE AND HOW DO YOU APPLY?

From 20 April 2020, eligible individuals can apply for Early Release of Super directly to the ATO through their myGov account at my.gov.au. The ATO has advised that to be eligible you must satisfy one or more of the following criteria:

- You are unemployed

- You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance

- On or after 1 January 2020, either

- You were made redundant

- Your working hours were reduced by 20% or more

- If you were a sole trader, your business was suspended or there was a reduction in your turnover of 20% or more.

Once an application is accepted, the ATO will liaise with your nominated superannuation fund to finalise the withdrawal of the funds. Eligible applicants were able to withdraw up to $10,000 before 1 July 2020, and a further $10,000 from 1 July 2020 until 24 September 2020. Applications for the 2019/20 Financial Year closed on 30 June 2020. However, the application period for the 2020/21 Financial Year has now been extended from 24 September 2020 to 31 December 2020.

If you are eligible and applied for COVID-19 early release of super in late June 2020 for the 2019/2020 financial year, you may receive the money in the 2020/21 Financial Year. This will not impact your eligibility to apply for a further release in the 2020/21 Financial Year.

Temporary residents are not eligible to apply in the 2020/21 Financial Year.

Withdrawals under the Early Release of Super provisions won’t be taxed and the money withdrawn will not be taken into account under any income or means tests.

CONSIDERATIONS

Before accessing your super under the early release provisions you should consider:

- Accessing Government assistance such as Job Seeker or Job Keeper.

- Speaking to your lender or bank to canvas any hardship provisions they may be able to offer you as a result of COVID19.

- The impact your withdrawal may have on any insurance benefits within your Super Fund. Withdrawing all funds or causing the balance to drop below the minimum balance may result in your insurance being cancelled.

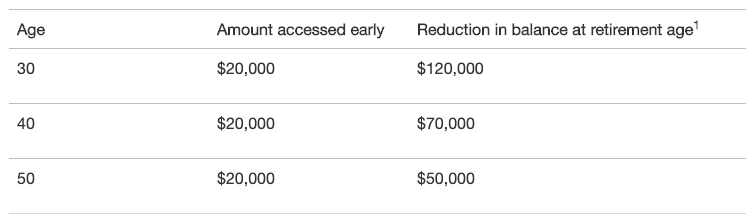

- The impact on your retirement savings as money you take out today will be money you don’t have in retirement. The following table by MLC highlights this impact.

1 Estimates based on a super balance of $100,000, with a 6% p.a. rate of return after fees and costs.

Moneysmart also provides a useful calculator on its website – https://moneysmart.gov.au/covid-19/accessing-your-super

- Selling down and withdrawing funds from your super amidst a down turn, will ‘lock in a loss’ and you will not be able to share in the gains when the share market bounces back. To illustrate the point, assume you own a share in your Super that has a price of $100. If you withdraw when the price drops to $80, and buy it back when the price returns to $100, you’ve locked in a loss of $20 for that share.

- The need to withdraw the full $10,000 or $20,000 over both financial years. Withdrawing only what you need to meet your essential commitments will minimise risks associated with locking in a loss and eroding your retirement nest egg.

- Beware of scams – always be sure you are dealing directly with ATO or your super fund or a known and trusted financial professional. ASIC has permitted registered tax agents to give advice about early access to superannuation, so you may want to seek the advice of your tax professional before lodging your application. You can also consult a Financial Counsellor or our office for guidance.

The content on this page is general advice only as we have not taken into account your personal and financial circumstances when making this recommendation. We invite you to contact us should you have any concerns about your current investments and/or if your circumstances have changed to ensure our previous recommendations remain appropriate.

Sources:

Australian Securities & Investments Commission (2020), 20-085MR ASIC grants relief to industry to provide affordable and timely financial advice during the COVID-19 pandemic, 14 April, viewed 21 April 2020 https://asic.gov.au/about-asic/news-centre/find-a-media-release/2020-releases/20-085mr-asic-grants-relief-to-industry-to-provide-affordable-and-timely-financial-advice-during-the-covid-19-pandemic/?utm_source=TPB+eNews+list&utm_campaign=2d2832ce57-EMAIL_CAMPAIGN_2020_03_12_03_50_COPY_01&utm_medium=email&utm_term=0_59bb5e57e6-2d2832ce57-75340825

Australian Taxation Office (2020, Support for individuals and employees, 14 April, viewed 21 April 2020 https://www.ato.gov.au/General/COVID-19/Support-for-individuals-and-employees/#Earlyreleaseofsuperannuation1

MLC (2020), ‘Wealth Warning: Things to consider about the Government’s $10K early release of super measure’, MLC Insights, 3 April, viewed 21 April 2020 https://www.mlc.com.au/personal/blog/2020/04/wealth_warning_thin